Only information can save your hard-earned money, being victimized by fraudsters

If there is a lot of dependence on the Internet, then there is a need to be careful about this. If this is not done, then cyber criminals can vacate the account by breaking into your hard-earned money with just one click. Apart from investigating the cases, the cyber police are also spreading the measures to avoid them. Despite this, people are constantly falling prey to it. In such a situation, Amar Ujala is also sharing these new and old tips for you once again.

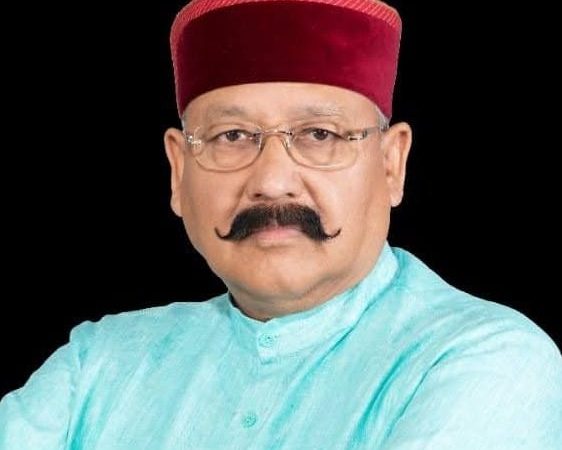

Let us tell that in Dehradun alone, about 20 people are becoming victims of cybercrime every day. Criminals are doing online transactions by taking information about people’s bank accounts, while some people are being blackmailed by implicating them in sextortion. Sometimes someone’s Facebook ID is made fake and sometimes someone’s Facebook ID is being harassed mentally by putting obscene messages on it. STF SSP Ajay Singh said that if some things are taken care of, then all these can be easily avoided.

what kind of fraud is happening

- By luring gifts in fishing mail.

- In the name of sending help by becoming a fake friend.

- Call or message for free recharge and cashback.

- By becoming a fake customer care officer.

- By sending a message in the name of a loan waiver.

- In the name of getting a loan in minutes.

- Blackmailing by creating fake social media profiles.

- By becoming a fake customer on OLX.

- In the name of bonus in the insurance policy.

- The link is sent as an acquaintance on the pretext of helping.

How to avoid falling prey to a phishing mail

- Do not respond to suspicious messages and emails.

- Block that email and number immediately.

- If someone asks for ATM PIN, then inform the police about it.

- If someone talks as a customs officer, give the number to the police immediately.

Identify who is a friend and cybercriminal

If someone’s friend request comes, then it is necessary to distinguish who is actually a friend and who is a cyber-criminal. For this, take care of few things and take these necessary steps in time.

- Check the friend list before accepting the request.

- Check the timing of photo upload.

- Check out complete information about him and the mutual friend list.

- If in doubt, block him immediately.

How To Avoid Fake Customer Care Officer

- Actually, these days more fraud is being done by becoming a fake customer care officer. What happens in this is that people look up the customer care number of a company or bank on the Internet and go to the fake website. This is where the game of fake customer care officers starts.

- Check the number only by going to the right website.

- If you are looking at the number of the bank, then it is also written on the passbook, debit, credit card, etc.

- Check the online review about the website from which the number is being taken.

- Even if someone’s call comes, do not give him the last transaction and personal details.

Will save a special tip with an account emptying link

These days money request facility is available on e-wallet phone pay, google pay, Paytm, etc. In this, anyone sends you a link and after clicking on it, money can be deducted from your account. Then it is up to the sender of that link that how much he sends the link. This may even empty your account. For this keep this special thing in mind…

keep app notifications on

For this, keep notifications of all these wallet apps on. If someone tries to enter your app, a notification will come on the browser. Here you will be asked whether you give permission or not. You can refuse this.

QR code is only for payment

Ajay Singh told that these days a lot of cheating is happening through QR codes. In such a situation, it is important to keep in mind that what is a QR code. QR code is only used for payment. If someone talks about sending you money through this, then he is saying it wrong. Make a complaint about it.

There are many more tips

- If someone talks about getting a bonus on the maturity of the insurance policy, then you should confirm it by visiting the branch. Or ask your agent through whom the policy was taken.

- No bank calls you and asks for OTP or account details. If such a phone comes to you then report it.

- Secure your profile on Facebook and other social sites. So that, from here no one collects the information of your friends, etc.

- On the temptation of getting loans in government schemes, etc., first, get information about it in your nearest government office and bank.

Complain immediately of 155260

If fraud has happened to you, then give immediate helpline number 155260. There is a possibility of getting the money deducted from your account through the centralized helpline. The cyber police station freezes the beneficiary account.